Mortgage rates are important because they determine how much home you can afford. But knowing what factors could drive them up and down can help you plan accordingly.

Experts predict mortgage rates to remain high this year and to drop slightly in 2023. But don’t expect anything like the pre-pandemic low rates.

1. The Federal Reserve’s Rate Hike

The Federal Reserve raised interest rates for the third time this year and sent a clear signal that it plans to continue to raise them in the future. The rate hike was smaller than expected, but it is still likely to affect mortgage rates.

The Fed raised its target for the federal funds rate by a quarter of a percentage point, which means that it will probably increase mortgage rates this week. The federal funds rate is the rate that banks charge each other to borrow money overnight or for a few days. The rate is used to help keep the amount of cash in the banking system stable. This is important because the Federal Reserve wants to make sure that there is enough money available to meet consumer needs.

Inflation has been running high, which is one of the main reasons that the Federal Reserve has been raising interest rates. If the inflation rate rises too much, it can hurt the economy. Inflation also makes it harder for people to afford homes because it costs more to purchase them. The rate hike this week will likely send the message that the Fed is serious about keeping inflation under control and is not willing to let it get out of hand.

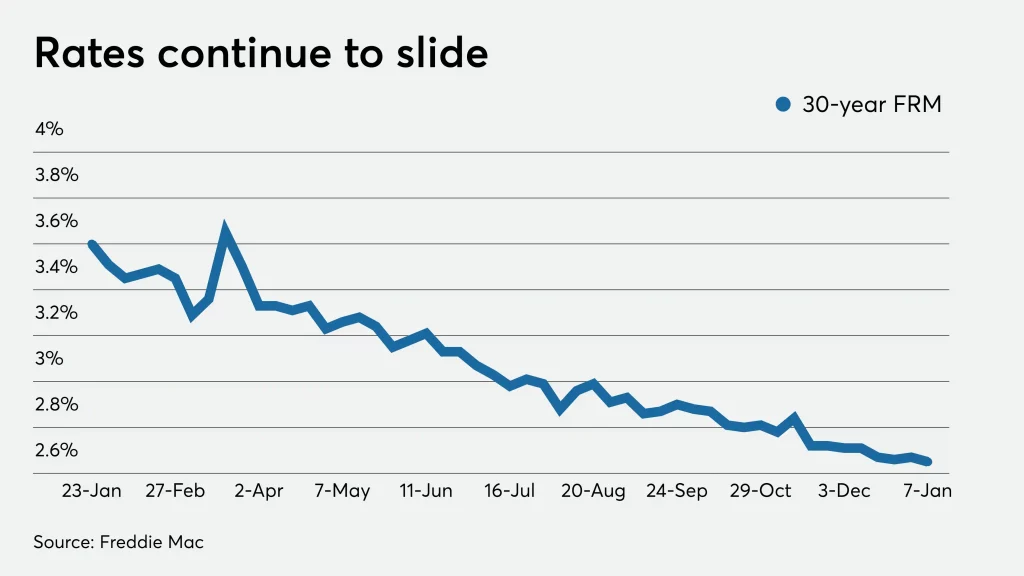

Mortgage rates don’t move exactly in tandem with the Fed’s benchmark rate, but they usually follow the yield on the 10-year Treasury note. Last week, mortgage buyer Freddie Mac reported that the average rate for a 30-year fixed-rate mortgage was 6.13 percent. This is significantly higher than it was a year ago, when the rate was 3.55 percent.

Experts predict that rising interest rates will continue to make homebuying more expensive for potential buyers. This may be a significant factor in slowing the housing market. In fact, pending home sales declined in March for the 11th straight month. High mortgage rates and a shortage of inventory have been blamed for the slowdown.

2. Inflation

When inflation rises, it decreases the purchasing power of money. This can lead to higher interest rates, as lenders will need to charge more to make up for the decreased buying power. The goal of central banks around the world is to find a balance between low, steady levels of inflation and mortgage rates that are affordable for home buyers.

The rise of interest rates is expected to put a damper on the spring selling season, according to some analysts. However, there are several reasons why homebuyers should continue shopping for a mortgage.

Mortgage rates are typically tied to the yield on 10-year Treasury bonds, which move based on a combination of anticipation about what the Federal Reserve might do next, actual Fed actions and investors’ reactions. As the yield on these bonds rises, so do mortgage rates; when the yield falls, mortgage rates also fall.

A rising inflation rate may be one of the reasons why mortgage rates are expected to rise this week. High inflation can lead to a lack of consumer spending, which slows economic growth. This can also increase demand for certain products, such as food and housing, which leads to higher prices. Inflation can also be exacerbated by a number of factors, including a weak economy, political instability and supply chain disruptions.

For homebuyers, a rise in mortgage rates can be beneficial if they are paying down their loan, as they will receive lower monthly payments in the future. It is also possible to save money by shopping around for the best mortgage rates, says personal finance expert Sarah Coles from Hargreaves Lansdown.

In addition to mortgages, homeowners can use their home equity to consolidate debt and reduce interest payments. However, it’s important to remember that a home equity loan is still a form of debt and can impact your credit score. If you’re considering using your home equity, it’s important to consult a specialist to make sure it is the right choice for you.

3. Job Growth

The economy is growing at a healthy clip, and this has helped to keep mortgage rates low, which in turn has given homebuyers the value they need to get into the market. However, if job growth continues to climb, it may start to put pressure on the Federal Reserve to raise interest rates. This will, in turn, cause mortgage rates to rise.

This is why it is so important to pay attention to the jobs report each month. This information is published on the first Friday of every month by the Bureau of Labor Statistics. The report measures nonfarm payroll employment and includes an overview of demographics, industry, and geographic data. It also provides the unemployment rate and wage growth.

In recent months, the jobs report has been very strong. This has sparked concerns about inflation and prompted the Federal Reserve to raise rates.

Normally, when rates are rising this would be good news for mortgage holders and potential homebuyers. However, this time around, the rate hikes were paired with a strong jobs report, which has made it harder to see any lower mortgage rates in the future.

It is not uncommon for the unemployment rate to fall while mortgage rates are rising, which makes it even more difficult to see any future lower rates in the near future. However, the recent slowdown in new hires is a sign that the job market may be cooling off.

For now, it looks like mortgage rates could end this week in the upper 6s, according to Freddie Mac’s weekly survey. This is a far cry from where they started the year, which was above 7%. While it is too early to know for sure, this may be the sign of a more lasting lower mortgage rate trend. However, there are still many factors that could influence this and other mortgage rates over the next few months. So, watch the jobs report and other economic data closely this week to see how it will affect mortgage rates. This will be a key factor in whether or not homeowners can take advantage of the current low interest rates and buy their dream homes.

4. Housing Market

Mortgage rates are sensitive to the housing market. When rates rise, homebuyer demand slows because buyers are less likely to buy homes or refinance if they can’t afford their monthly payments. Meanwhile, homeowners who lock in lower mortgage rates don’t want to sell and tighten up the supply of available homes, making it more difficult for buyers to find what they’re looking for.

Despite the slowdown, the economy remains robust and many experts believe that the Federal Reserve will eventually end its rate-hike campaign. This may give the housing market a chance to re-accelerate.

Last week was wild, and not just because of the 21st century bank run that led to Silicon Valley Bank’s temporary closure. The turmoil spooked bond traders, who sold stocks and bought bonds, sending 10-year yields and mortgage rates lower.

The low rates helped mortgage applications, which are a leading indicator of new home sales, rebound after three weeks of declines. However, they remain well below historic highs, suggesting that today’s higher mortgage rates are still depressing the housing market.

A separate measure of housing market activity, new-home sales, declined in March for the fourth straight month, according to the National Association of Realtors. The drop was attributed to “continued weakness in the labor market and mortgage rates,” NAR Chief Economist Lawrence Yun said in a statement. Yun also warned that the inventory of new homes on the market remains too low to meet demand.

Existing-home sales, which account for the majority of real estate transactions, were also weak in March. Pending home sales, which are based on contracts that haven’t closed yet, dropped by 5.2% in March, the largest decrease since October 2015. Experts say rising mortgage rates and limited inventory are pushing potential homebuyers away from the market. If this trend continues, it could push existing-home prices down by 1.8% to 10% in 2023, according to CoreLogic. This would be good news for first-time homebuyers who have been waiting for prices to fall before purchasing a house. Nevertheless, the housing market is a cycle, and it will take time for property prices to ebb and flow between a buyer’s, seller’s or balanced market.

Conclusion

As an AI language model, I don’t have access to real-time financial data or market predictions, so I can’t confirm whether mortgage rates this week are expected to rise. However, mortgage rates are subject to many factors that can affect them, including economic indicators such as inflation, employment, and consumer spending, as well as global events, such as geopolitical tensions or pandemics.

It’s important to keep in mind that mortgage rates are constantly fluctuating, and it can be challenging to predict their movements with certainty. That said, if you’re considering applying for a mortgage, it’s a good idea to monitor mortgage rates closely and consult with a lender or financial advisor to help you make an informed decision.

Here are some FAQs related to mortgage rate fluctuations:

- What causes mortgage rates to change?

Mortgage rates can change based on a variety of factors, including economic indicators, inflation, employment, consumer spending, global events, and more.

- How often do mortgage rates change?

Mortgage rates can change frequently, sometimes multiple times in a day, depending on market conditions.

- Should I wait to apply for a mortgage if rates are expected to rise?

It’s difficult to predict the movements of mortgage rates with certainty, and waiting for rates to drop can be risky. If you’re ready to apply for a mortgage and feel comfortable with the current rates, it may be a good idea to move forward with the application process.

- How can I get the best mortgage rate?

To get the best mortgage rate, you can start by shopping around and comparing rates from multiple lenders. You may also consider improving your credit score, making a larger down payment, or opting for a shorter loan term.

In summary, mortgage rates are subject to many factors that can affect them, and it can be challenging to predict their movements with certainty. If you’re considering applying for a mortgage, it’s a good idea to monitor mortgage rates closely and consult with a lender or financial advisor to help you make an informed decision.